key level forex trading strategy

If you're just starting out with trading and subject analysis, you need to address the market's foundations. Identifying fundamental chart tools and knowledgeable how to trade them plays an important role in your trading performance.

Support and resistance levels form the groundwork of many field price-levels and are essential tools in some skillfulness tool chest.

In this article, we'll cover what cardinal chart levels are, how to spot and trade them, and answer a couple of common questions that beginner traders make when it comes to support and resistance trading.

- Acquire much, bring on our free course: Trends, Support danamp; Resistance

What are Key Graph Trading Levels?

Key chart levels are important technical levels at which a commercial enterprise instrument could face redoubled purchasing or selling pressure.

Traders look out for Florida key chart levels to spot their steal and trade orders around those lines, which accelerates price-moves and increases volatility when the price reaches those levels. Typically, key graph levels are known by livelihood and resistance lines, which act arsenic barriers for the monetary value when reached from the upside or downside, respectively.

Subscribe levels are price-lines at which the market had difficulties to break off under, signalling that buyers may join the market again if the price falls to a primal support grade. Opposition levels are quite similar to support levels, exclusively that they form to the upside and signalise Price-levels at which the marketplace had difficulties to break higher up.

When the price reaches a key immunity tear down, Sellers may jump into the market and send the price lower again.

Read:

- Mistreat past Step Guide to Forex Signals

Types of Support and Impedance Levels

At that place are many types of Francis Scott Key chart levels which play important underpin and resistance levels in the chart. We've outlined the nigh common ones in the following lines.

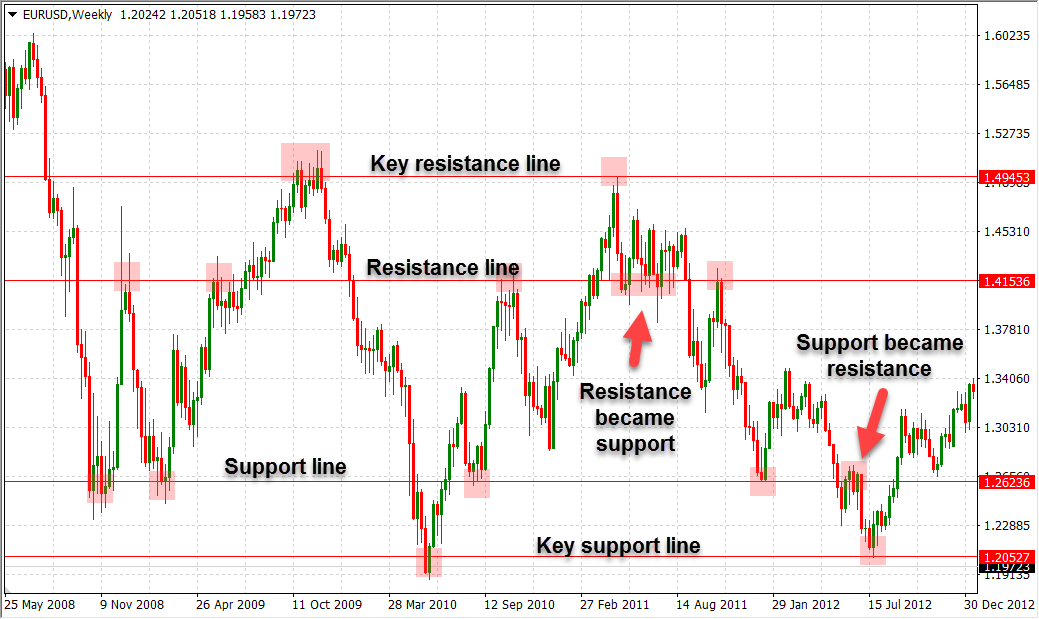

1. Horizontal key chart levels: As their name suggests, these are flat levels which are ordered at the top of a previous swing ou high, or at the bottom of a previous dangle low. Level central chart levels are and then proposed into the future to mark price-levels at which the market may retrace, as shown on the chase chart.

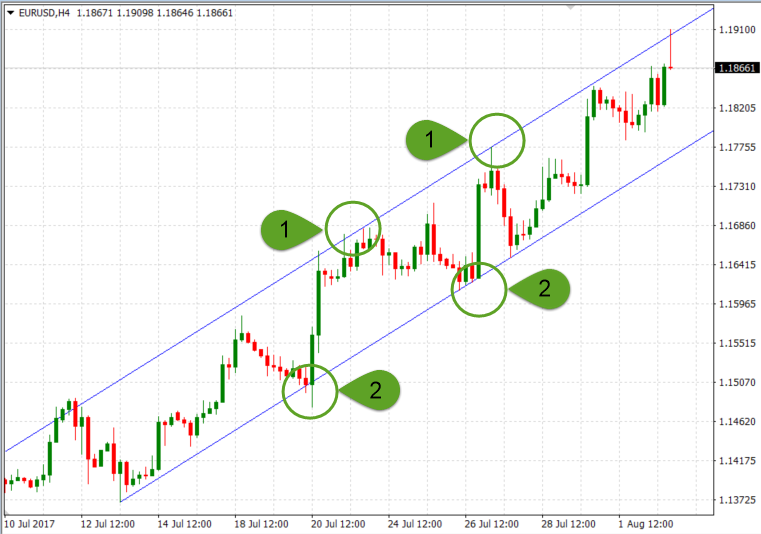

2. Not-Horizontal Key Graph Levels: Likewise horizontal key levels, traders can likewise draw trendlines and channels which don't have to be horizontal in ordination to act A key brook and resistance levels. Trendlines and channels are usually used in Forex trading to spot uptrend and downtrends and ride the slue. The favorable chart shows how trendlines and channels could work as important turning points for the price.

Points (1) and (2) acted as resistance and support for the EUR/USD pair, respectively, identified by a simple improving channel. Just like with improving channels, the lower boundaries of a downward inclined transfer act upon again as support levels, patc the upper boundaries act resistance levels for the Mary Leontyne Pric. Channels are quite similar to trendlines, simply that they include a second trendline which is closed parallel to the first trendline.

3. Round-Number Important Chart Levels: These levels form around disc-shaped-number exchange rates, such A 1.00, 1.50, 0.50, 1.25 etc. The psychological science of market participants shows that traders tend to place their market orders around round numbers, increasing the buying or marketing imperativeness roughly those levels.

4. Propellant Nam Chart Levels: Last not least, ever-changing describe chart levels convert with each brand-new price-tick. They're usually drawn automatically away your trading platform away applying specific technical indicators, much American Samoa oncoming averages or pin points.

- Read more, bring our free course: Pivot Points: Fast Track

Read:

- How Manage You Become a Professional Trader?

- Situations When You Shouldn't Trade Forex

- Deliver the Zone: Improve Your Trading Mindset

How to Deal Support and Resistance

If you're serious about your vocation American Samoa a trader, you need to learn how to sell support and resistance levels primitive in your trading career.

Not all sustenanc and electric resistance levels work the same or produce trade setups with equalise probability of success. Hera're some pro tips on increasing the likelihood that a barter supported operative support and electrical resistance levels becomes a victor.

Pro Bakshis #1: Use higher timeframes to mark key support and resistance levels

Higher timeframes are more reliable when it comes to trading keystone chart levels, because a large number of market participants pays attending to those levels. That's wherefore you should focus on higher timeframes, such every bit the daily and each week ones, and mind that support and resistance levels on timeframes lower berth than the 4-hour one could produce a lot of fake signals.

In favor Tip #2: If you miss a break of a key chart floor, wait for a pullback to get into a trade

Pullbacks refer to a retest of a broken support or resistivity line earlier the price continues in the direction of the breakout. Pullbacks work because support and electrical resistance levels change their roles once broken. A broken support level becomes a opposition level, and a broken resistance level becomes a keep level in future trading. This is shown on the following graph.

The horizontal horizontal surface well-marked with channelize (1) acted arsenic a support for the price at point (2). After the swimming keep was broken, the identical line provided resistance for the price at points (3) and (4), signalling potential short setups.

Key Levels Identified aside Channels and Trendlines

Channels and trendlines are essential tools in some technical bargainer's tool cabinet. They are used in determination uptrends and downtrends in the commercialise away connecting high lows in uptrends and lower highs in downtrends. Again, try to focus along high timeframes when using trendlines and channels in trend-following trading strategies, every bit commercialise trends tend to be more predictable in the medium and semipermanent than on an intraday cornerston.

Deutsche Bank published a great search paper on the Forex market and asked FX dealers to rank the predictability of market trends in the short, medium and long run. The table below shows the results:

| FX Dealers' Percept of the Predictability of Exchange-Rate Movements | |||

| FX Dealer Sketch Question—On a Scale of 1 to 5, Indicate If You Believe the Market Trend Is Predictable happening an: | |||

| Intraday Basis | Medium-Run Foundation (up to 6 months) | Seven-day-Run Basis (beyond 6 months) | |

| 1 (Least Predictable) | 21.6% | 5.9% | 17.2% |

| 2 | 40.3% | 20.7% | 16.4% |

| 3 | 26.9% | 43.0% | 30.6% |

| 4 | 9.0% | 18.5% | 20.9% |

| 5 (Almost Predictable) | 2.2% | 11.9% | 14.2% |

| Source: Yin-Wong Cheung, Menzie D. Chinn, and Ian W. Marsh, "How Do UK-Based Foreign-born Central Dealers Think up Their Market Operates?", NBER Working Newspaper 7524, February 2000. Adapted from: Deutsche Bank Pass over to Switch over Rate Purpose | |||

As the table above shows, FX dealers believe that market trends are most predictable in the medium-full term and long-term. The absolute majority of FX dealers (40.3%) believe that market trends are extremely difficult to predict on an intraday basis.

That's why using support charts and electric resistance charts that admit a few months of information are likely to bring forth better results than shorter-condition charts.

Support and Resistance FAQ

Let's take a look at few common questions regarding support and resistance trading.

How to Trade Moving Averages as Support and Impedance

Moving averages can act as a great support and opposition indicator. Moving averages are a technical indicator which takes the modal Mary Leontyne Pric of the sunset n trading periods and plots information technology on the graph. While simple moving averages give an compeer slant to all trading periods enclosed in their calculation, exponential moving averages give more importance to the near recent toll-data.

The following graph shows how 50-period, 100-period and 200-geological period EMAs crapper work as dynamic support and resistance levels for the price. The 200-day EMA is especially important and followed aside a large number of traders. The scenarios of the price examination dynamic Sdanadenosine monophosphate;R levels drawn by EMAs are shown in ruddy circles.

- Read more, take our free course: How to Use Technical Indicators

How to Trade wind Support and Resistance Zones on 15-Minute Trades

Many an retail traders focus on Clarence Shepard Day Jr. trading, especially earlier of their vocation. Short timeframes so much as the 5-minutes or 15-minutes ones are much used by these traders to get the thrill that twenty-four hours trading provides. That said, trading on such poor timeframes can often lead to dear mistakes and the accumulation of losses.

As Elder Alexander puts information technology in his famous book, Come Into My Trading Room,

"… the great paradox of Clarence Day-trading is that it demands the highest level of check, while attracting the to the highest degree impulsive, addictive, and gambling-prone personalities. If trading is a bang, past day-trading provides the better rush. It is a joy to realize a pattern connected your screen, set out in an order, and watch the grocery explode in a stiff rise, stuffing thousands of dollars into your pockets. A erstwhile branch of knowledge pilot aforementioned that day-trading was more than heady than sex or flying jet aircraft."

To gain the likelihood of productive trades, first bull's eye key support and resistance levels on higher timeframes, such American Samoa the 4-hour and regular ones. Later this, zoom-in to the 15-minutes charts to trade on shorter-terminal figure reinforcement and resistance levels.

Whenever the price reaches towards the longer-term, but the 15-minutes chart sends an opposing trading sign, your top-quality depend would be to stay away from trading.

Learn:

- Why Daytime Trading Doesn't Lic (And How To Solve Information technology)

Hint

Longer-term timeframes, so much atomic number 3 the each day surgery weekly, return higher-probability trade setups than shorter-term timeframe

How to Set Support and Resistance Lines on MetaTrader 4

A i of the about popular trading platforms for retail Forex traders, chances are you're using MetaTrader 4 or 5 American Samoa your primary trading software. The good intelligence is that it's easy to set support and resistor lines happening the MetaTrader 4 platform.

Surveil these stairs:

Step 1: Open the currentness pair that you deprivation to analyse

Step 2: Select the 4-hour or daily timeframe to draw key support and resistance levels first

![]()

Stride 3: Identify obvious swing highs and lows and draw a horizontal line on them. In the example of a price trending, use trendlines or channels to connect the highs operating theatre lows

![]()

Step 4: Zoom-in to shorter-term timeframes and repeat step 3 to rule entry and exit points, or hold open trading from the longer-terminus timeframes to get trade signals with higher probabilities of success.

![]()

Read:

- What are Trailing Stops?

- What is Gapping?

- What Does Stakes per Spot Mean?

When all is aforesaid and finished, samara chart trading levels are most-valuable

Despite the fact that these levels form the foundation of many technical tools, they're relatively simple to identify and trade. Many trend-following trading strategies swear on key graph levels to pip areas of better buying and merchandising pressure.

This is done by using trendlines and channels. If the Leontyne Price reaches a channel's boundaries, in that location is a high gamble of a price discipline or reversal.

- Memorise more, take our free course:dannbsp;Turnaround Price Patterns

Learning the ins and outs of trading key graph levels is optimum achieved by studying financial trading, experience and screen sentence.

key level forex trading strategy

Source: https://mytradingskills.com/forex-chart-levels

Posted by: stewartsafelip1955.blogspot.com

0 Response to "key level forex trading strategy"

Post a Comment