What Is Profit In Forex

Some people say that currency, or foreign commutation, trading can exist challenging.

Well, they are right!

Success in the world of forex is oft a combination of several things.

Many years ago, forex trading was mostly for the big players. Today, with technological advancements, information technology is possible to accept retail investor accounts.

Well-nigh publications guess that upwardly to 90% of new entrants practice not succeed. There are many reasons why this happens, and this article is focused on correcting one of them.

Long-term profitability in forex is often a result of information-driven decisions. 1 way to ensure this is by applying technical analysis.

Technical assay is a detailed assay of statistical trends gathered from trading activity. Information technology is a nifty way to evaluate investments and identify trading opportunities.

This commodity is for people who want to start trading, novice traders, and professionals.

You will learn:

- What technical indicators are

- The different types of forex indicators

- Pros and cons of each of the types

- Top forex indicators

- How to utilise forex indicators

- How to use multiple indicators

- The best forex trading platforms

- And much more than!

Become comfortable as we explore the world of forex indicators.

What are forex technical indicators?

Many indicators give an overview of market place conditions. They are a visual representation gotten by examining and analyzing brusque and long-term boilerplate price movements.

Also, forex indicators can assist y'all become better merchandise results in real-time (especially if you prefer to trade online).

Many traders apply indicators to empathise how the marketplace is performing and anticipate futurity changes. Indicators are a core aspect of any effective trading strategy. They are the boulder of informed trading decisions and, subsequently, college returns.

The currency trading market is largely unpredictable. Therefore, you lot must make calculated moves and improve your trading strategy.

Why are forex indicators important?

Well-nigh traders need to empathize market volatility at all times and with indicators, they can stay abreast. Forex indicators institute investment communication backed by data.

Indicators provide answers to some of the most disquisitional questions that forex traders ask.

Questions like:

"Is the market overpriced?" or "Which levels are good entry points?" or "Which currency pairs are spring to be more valuable?"

Whether it is short-term, swing, or long-term investing, indicators provide helpful trading signals. Traders and investors can build positions and open up a position or new trade with this information.

Many forex traders cannot perform a primal analysis of the marketplace. If you fall under this category, you lot are exactly where you need to be; hither.

With indicators, you tin can successfully trade and invest in various markets across the world. Yous will gain access to the essential trader signals and assay.

Furthermore, indicators help investors to sympathize and clarify market trends. They help yous predict uptrends, downtrends, and sideways moves.

Timing plays a crucial part in forex trading, and you need to accurately predict the right time to enter a merchandise. Many traders piece of work with the aid of forex technical indicators such as chart patterns, candlesticks, moving averages, etc.

These indicators assistance you to identify central limit levels and close trades that are going the wrong way. They also provide early on signals about the movement of market place makers and their activities.

Similarly, they also aid traders to predict a market reversal.

Compared to fundamental analysis, forex indicators provide you with loads of information at a less expensive price. The latter besides provides quicker chart results and prevents you from losing coin rapidly.

Key Takeaway: Forex indicators are like an open book, a map that tin can help you make great gains. Yet, there are likewise times when they tin cause significant losses. Indicators do non necessarily guarantee gains.

What are the different indicators in Forex?

The main cistron that influences your choice of which indicator to use is your trading goals. However., it is easier to determine the all-time type of forex indicator for you when you understand the differences and similarities.

For the purpose of this article, we volition categorize indicators into 3 broad groups:

LEADING INDICATORS

A leading indicator uses past price data to forecast future motion in prices in the market place. Traders tin can get an early warning and understand the direction of the merchandise before a new tendency starts.

One of the downsides of leading indicators is that they are sometimes misleading (infamous cases of many false signals). The leading indicator is not always correct; you may experience fakeouts.

Leading indicators are non perfect; however, you can get bang-up benefits when you use them appropriately in the context of a trend framework.

Examples of leading indicators include:

- Fibonacci replacements

- Support and resistance levels

- Ichimoku indicator

Ichimoku Indicator

Developed by Goichi Hosoda, the Ichimoku indicator measures and predicts cost movement. It is a trend-following system with an indicator similar to moving averages.

Pros

- Predicts toll movement and provides favorable entry points for a possible move

- Offers dynamic support and resistance levels

- It is a smashing way to measure the direction and intensity of market place trends

Cons

- Due to the advanced technical analysis, leading indicators may be difficult for new traders.

- The forecasted price action is not guaranteed. Therefore, traders may demand to apply their own knowledge of indicators in every situation.

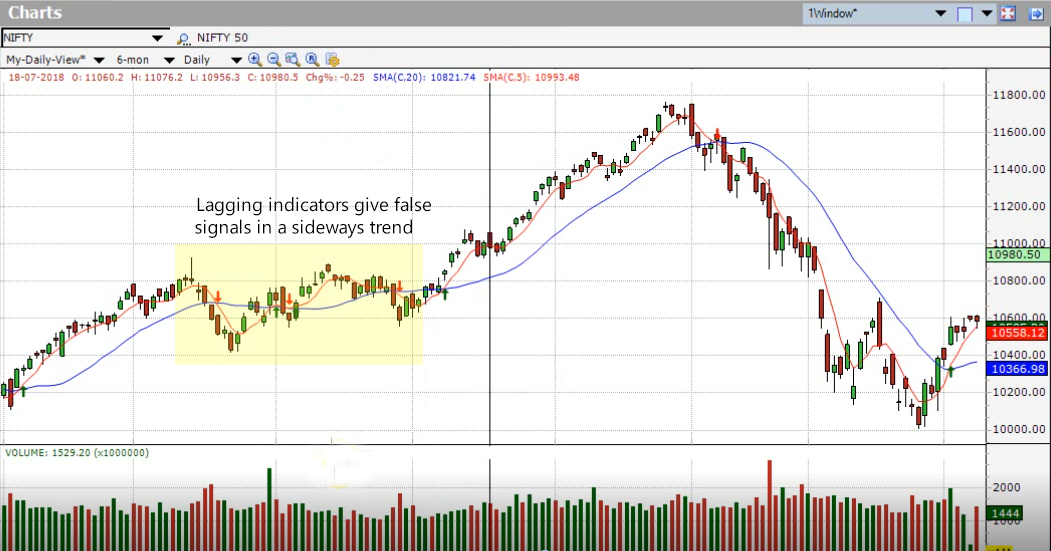

LAGGING INDICATORS

With a lagging indicator, you lot can use the average of the previous price action data to analyze the markets.

Most times, there is a lot of market noise, and this distracts buyers. A lagging indicator gives yous a point that a tendency has started based on previous closing prices.

They are most efficient in cases where prices move in relatively long trends.

A price chart is non the only factor to consider when looking for marketplace signals. Other lagging indicators can be very helpful. They assist you to become a better thought of the marketplace tendency.

However, in most cases, yous enter the position late.

Examples of lagging indicators include:

- Moving Average Convergence Divergence (MACD)

- Simple Moving Average (SMA)

- Relative Strength Index (RSI)

Pros

- Lagging indicators reduces the high risk of failed moves or false breakouts

Cons

- Traders sacrifice potential pips past waiting for a go-ahead from the lagging indicator.

- Lagging indicators don't warn y'all of upcoming changes in prices. They but tell you how the prices are rising or falling so that you tin can trade accordingly.

CONFIRMING INDICATORS

When it comes to trading, there is no such thing as "too sure". This is why we have to confirm the assay of technical indicators. These kinds of indicators are extremely useful for validating toll analysis.

In cases where you apply several indicators to create an analysis, you need to validate your toll.

An example of a confirming indicator is the On Balance Volume- OBV. The OBV readings focus on what drives the trend. This is a dandy fashion to understand and rightly predict whether the market is moving in an uptrend or in a downtrend.

Suppose, for whatever reasons, you conclude that an uptrend will contrary. In that example, you tin can use the OBV indicator to confirm your analysis.

Other types of forex indicators

Autonomously from the above, FX technical indicators tin be further bundled based on the data extracted from them.

In that location are endless different indicators that you can use to get merchandise signals.

![]()

TREND INDICATORS (Moving Averages, Parabolic SAR, MACD)

Trend indicators are some of the near of import forex indicators. Forex traders often argue that you should simply trade with the trend. A trend indicator will help you to identify a trend. This makes it like shooting fish in a barrel for you to make up one's mind at which level to enter the trade.

VOLATILITY INDICATORS (Bollinger Bands, Envelopes, ATR)

Using ranges, these indicators prove the behavior of the toll and volume behind whatsoever movements. They are of import considering dramatic changes in behavior can provide a good entry signal.

MOMENTUM INDICATORS (RSI, Stochastic, CCI)

Momentum indicators are useful to determine overbought or oversold positions. These types of indicators provide the best signals of new trends. As the proper name suggests, a momentum indicator shows the momentum with which price movements happen in the market.

FOREX Book INDICATORS

These types of indicators evidence the book of trades behind a toll move. They follow the principle of evaluating the general amounts of financial instruments being traded within a fourth dimension frame. This data is visualized on the chart for the trader to sympathize how the market is performing.

They help you differentiate between price movements with higher volumes (strong signal) from lower volumes (depression signal).

CUSTOM INDICATORS

Earlier in the article, we mentioned how it is preferable to combine indicators. With custom indicators, you tin modify parameters freely within charts, Based on your trading goals.

Generally, custom indicators are created using simple algorithms with existing variables. Some systems for custom indicators require coding, while others provide a fix user interface that eliminates the need for coding.

You tin create custom indicators based on your trading goals. They tin can exist used to create alerts when market movements trigger a trend or a price reaches certain levels. This helps y'all proceed an center on the market. Some usually used platforms include; MetaTrader 4 or MetaTrader five.

Fundamental Takeaway: There are no perfect indicators. Forex indicators guide traders and help them notice likely outcomes. While leading indicators perform all-time in sideways markets, lagging indicators are great for trending markets. This is not to say that you have to exclusively apply one or the other. However, you tin combine both effectively when you lot understand the potential pitfalls of each.

Allow'south take a await at some other forex technical indicators:

OSCILLATORS

Oscillators are the proper foundation to evaluate currency pairs. As the name suggests, the indicators oscillate between fixed values in relation to the actual asset price.

With the data obtained from this, professional traders tin can predict future price movements. Information technology also helps you gauge the strength or momentum of the directional move.

Oscillators differ based on their respective uses. While some were made to identify good trading opportunities, others were made to interpret trending markets.

Knowing the all-time indicators to apply for what circumstances will brand a world of divergence. It is ane of the key things that differentiates successful traders from unsuccessful ones.

An example of a popular oscillator is the Relative Force Index (RSI).

The RSI indicator measures the extent of recent price changes and determines overbought and oversold conditions. Developed past Welles Wilder Jr., today, the RSI indicator is one of the well-nigh trusted oscillators.

/BollingerBands-5c535dc646e0fb00013a1b8b.png)

BOLLINGER BANDS

Bollinger bands are designed to measure out the pricing volatility of securities. They were introduced in 1893 by John Bollinger.

Bbs are not intended to define market entry/get out points. Rather, they provide a detailed look at volatility, and they exist as a prepare of moving averages.

Traders of currencies often wait for incremental price moves. This is easier when traders apace recognize high-level volatility and trend changes.

The main purpose of this indicator is to help traders stabilize market prices. It also helps them decide whether assets are priced reasonably and when the price reaches a lower or upper limit.

These details assist investors to make up one's mind whether they are paying a fair price for the asset or not. This technical indicator features the upper band, midpoint, and lower ring. Each of these is represented by a signal line on the pricing chart. Traders often use them to discern the market state.

The upper and the lower bands are based on a standard deviation of the price from the moving average. Bollinger bands suit themselves to marketplace conditions past measuring volatility.

Although BBs are trademarked, they are available to the public. They are also non recommended as an exclusive method to understand price movement. However, forex traders tin can combine them with other tools.

Pros

- BBs provide an in-depth overview of the trend.

- With the squeeze signal, BBs heighten trading opportunities for traders.

Cons

- The bands never truly describe changes in the trading environment; the process revolves largely effectually the guesswork.

- They do not predict the effect; they merely react to ongoing trading matters.

Primal Takeaway: When outlining his Methods, John Bollinger recommended that traders use a 20-day moving toll average to clarify markets. Although technical indicators accept their downsides, the Bollinger brands have become such a useful tool in identifying extreme short-term prices in a security. Prices are considered overbought when stock prices continually touch the upper band. Conversely, when prices reach the lower band, they are oversold and would trigger a buy indicate.

/PivotPoint-5c549c1246e0fb000164d06d.png)

Pivot POINTS

A pivot point refers to the price at which the direction of the price movement changes. It is calculated by analyzing the loftier, low, and close of the previous trading solar day.

The data gotten from this technical indicator represent the intraday point of balance betwixt buyers and sellers. This helps yous to recognize where nigh of the trades are taking place.

Pivot points serve as indicators used past floor traders to determine directional movement (pivots) in the bolt market.

They became popular when traders of the flooring exchanges began to use them. They are used to decide when market sentiment changes from bullish to bearish or vice versa.

They are mostly regarded equally an accurate leading indicator. This is because almost participants in the bolt market are watching and trading those central levels.

In cases where the price exceeds certain levels of support or resistance, it affects the rest of the trading day.

You can access gratuitous pivot point calculators from several tertiary-party websites and retail forex brokers.

Pros

- Pivot points remain one of the nigh reliable leading indicators in forex trading

- They work well in liquid markets

- They offer first-class support/resistance levels

- A pregnant number of market place participants watch and trade with pivots

Cons

- For best entries, information technology needs to exist complemented by other technical indicators

- Offers imitation signals during non-trading days

/Figure1-5c425ae246e0fb0001296aaf.png)

MOVING Average CONVERGENCE/Difference (MACD)

The Moving Average Convergence/Difference is used to evaluate the swift price changes. Information technology is a popular tool used to understand the momentum backside a breakout. This understanding tin help traders to spot probable breakouts before the price touches the signal line of resistance.

The MACD indicator uses a histogram to amend understand market conditions. Apart from spotting breakouts, it tin can also help traders determine when to close their position.

Prices may reverse when momentum is dull; however, with the MACD indicator, traders tin be on alert. Based on the momentum of cost changes, traders tin maximize earnings.

Pros

- With multiple data points, the MACD is a more than expansive technical indicator than several alternatives.

- Information technology is possible to customize MACD on shorter timelines.

- In cases where the default calculations are too broad to exist consistently relevant, you lot tin can better the value of MACD.

Cons

- Accurateness may be reduced during highly volatile conditions.

RELATIVE STRENGTH INDEX

The RSI is one of the all-time forex indicator tools for evaluating potential forex breakout. It uses a 100-betoken scale to analyze purchasing trends.

It has become a relevant way of measuring and determining whether conditions for currency pairs are overbought or oversold.

In most cases, overbought or oversold atmospheric condition point to potential toll reversals and potential reversal breakouts. You are more than probable to encounter a market correction when the RSI is closer to either farthermost.

For example, a forex pair is considered to exist oversold when the RSI dips below 30. This can betoken a potential increase in the demand for that pair and somewhen lead to a toll breakout.

Pros

- RSI is a highly straightforward indicator

- It naturally complements several indicators, such as the MACD. The RSI is seen equally a slap-up indicator to pair with.

- The RSI is proven to work not only in forex but in other markets.

Cons

- There are cases where the RSI provides false indications considering data used to calculate it can lag in a trending market place.

PARABOLIC SAR

The PSAR is constructed by placing a dot to a higher place or below a prevailing trend on the pricing chart. This technical indicator examines a security'south momentum and provides valuable information to traders.

Like other oscillators, the Parabolic Cease And Opposite (PSAR) attempts to establish whether a market place is overbought or oversold.

Designed by J Welles Wilder Jr., it is used to identify tendency management and potential reversal points. Even so, it does non use any kind of standardized calibration. Rather, it uses a series of strategically placed 'dots.'

For uptrends, dots are placed beneath the toll, while dots are placed above for downtrends. The PSAR helps traders to project the stop of a tendency.

This technical indicator uses recent farthermost price (EP) data and an acceleration cistron (AF) to make up one's mind where dots appear.

Pros

- The dots tin can be interpreted straightforwardly

- With the PSAR, you lot tin can leverage trend reversals

- Information technology tin can exist used to make up one's mind support and resistance levels

- Information technology performs well in a trending market

- It is one of the known complementing technical indicators

Cons

- The PSAR does not provide skillful signals during sideways market conditions

/support-and-resistance-1-572b74e33df78c038efe0b14.jpg)

Back up AND RESISTANCE LEVELS

In uncomplicated terms, back up levels refer to a cost that a currency pair will not likely autumn beneath. In dissimilarity, resistance levels refer to the price that the currency pair will likely never exceed.

This is some other tool that provides forex traders with valuable insights. Information technology looks into the supply and demand of a security/currency pair to empathize why things happen.

Support and resistance levels are a crucial chemical element of technical analysis. They help investors understand what is going on in the markets.

The information obtained from analyzing key levels tin predict whether a current tendency volition keep going or reverse.

A currency reaches a support level because a drop in value has caused more than buyers than sellers. Conversely, a currency hits a resistance level afterward a sharp price increase.

However, it is of import to annotation that back up and resistance levels are non ever confirmed. Man psychology is a major driving factor for the forex marketplace. Therefore, global markets will regularly experience psychologically significant levels of support and resistance.

E.g., a currency may suspension by resistance and the price activity still attracts the interests of many investors and afterward enhance the price. Yet, other participants of the marketplace may sit dorsum and wait for the currency to lose value. The latter'southward decision to agree back could become a new source of support.

Pros

- Helps investors to identify ranges in currency trades

- The use of price activeness trading will greatly influence your merchandise entry

- This indicator presents a swell risk to reward ratio (for trades that work)

- It is a great way to manage risks in the marketplace

Cons

- There may exist false breaks

Central takeaway: it is important to understand that each indicator has its unique role. For the best trading results, yous need to avert redundancy. This is a case where yous mix two indicators with the same signal and this leads to double signals.

Lastly, note that marketplace signals aren't stronger merely because 2 or more dissimilar indicators confirm 1 another.

How to utilise forex indicators?

The forex market is driven past humans, and human nature does non change. Therefore, when you lot pay attention, you tin can spot patterns and apply them to your advantage.

With indicators, you can organize and categorize these patterns. Subsequently, y'all can gain insights and create successful trading strategies.

Indicators are best maximized when they are combined. With thousands of different options on the market, traders must narrow downwards options and make a option.

Technical indicators are computerized calculations that are used to forecast price changes in financial markets. With the kind of data that indicators provide, traders can confidently go into trades.

Different technical indicators offering different options. Therefore, your choice of indicators is critical to how effective they are.

TIPS FOR FOREX TRADERS

- A Forex Indicator is best combined with more than subjective forms of technical analysis. This way traders can get real-time buy and sell signals Given their quantitative nature, they can besides exist incorporated into automated trading systems.

- With hundreds of indicators in the market today, information technology is hard to understand them all. It is recommended that y'all use two (or at nearly 3) indicators per merchandise.

- A higher number of indicators does non guarantee success in trading forex.

- To become the most of the indicators, combine technical analysis with cardinal assay.

- Patience is an important virtue when it comes to trading forex. Some indicators require more time before their predictions happen.

- Each forex indicator comes with default values. It is best to adapt these values to suit your trading design.

Key Takeaway: As a trader, yous need to empathise currencies and how they height in dissimilar markets. Indicators provide insights into this, by using the correct indicators, you can safely make assumptions. To decide the correct currency pair, you likewise need to get the daily boilerplate toll range.

Which are the nigh accurate and popular forex indicators?

Forex markets present a bang-up opportunity to build wealth. However, information technology can as well be an uncertain territory to explore. With reliable forex indicators, the journey is somewhat easier.

You lot don't have to be an expert to get the most from forex trading. With reliable, trustworthy, and verified forex bespeak providers, you can go insightful trade signals.

Today, there are countless forex signal providers all promising to provide excellent services. It is hard to spot the fakes; however, we have made it easier.

We compiled a list of the best forex indicators.

Check out the post-obit if you are looking to explore the earth of indicators equally a trading strategy.

- Elliott Wave Forecast: This is i of the largest technical assay companies in the earth. They offering a range of nugget groups such as forex, bolt, cryptocurrency, stocks, etc.

- Larn ii Trade: This platform provides forex signals, marketing analysis, forex trading recommendations, and many more in real-time.

- MQL5: This platform is unique and highly diversified. It places a lot of accent on performance to create trading signals.

- Forex signal factory: Although this platform is not as popular equally most forex trading platforms, it is i of the best free forex indicate providers on the market today. Information technology is a bang-up option for beginners.

- FX Leaders: This platform adopts various trading strategies to ensure trader success. It offers both gratuitous and premium services to users.

- WeTalkTrade: This platform is increasing in popularity through its pinnacle-notch application services. Their app is compatible with IOS and android, and it offers you real-fourth dimension insights.

- ForexGDP: Known as 1 of the top forex signals providers, ForexGDP offers trader alerts with a trading arrangement offer targeted gains of 300-1500 pips per calendar month.

New forex indicators

If yous are new to forex, these are some of the best forex indicators for beginners:

- Forex Olympus

- Trendy master

- FX cantlet pro

- Fibo Quantum

- X scalper seventy

- Infinity Scalper

- Fxenigma

Primal Takeaway: Earlier choosing what indicators to use, you demand to understand the categorization of indicators. This categorization helps you lot to use indicators that complement i some other. Also, notation that some indicators can be multifunctional and tin be used under different circumstances.

Conclusion

With far more activeness than the stock market itself, the forex market is one of the most pop trading markets in the world.

The market is dynamic, and it moves co-ordinate to the laws of need and supply. Every twenty-four hour period, millions of traders try to take reward of the slight changes in substitution rates, either through trading CFDs or other avails.

This article has gone through some of the best forex indicators on the market today. Forex indicators help traders visualize how need and supply moves. Furthermore, indicators help them to filter the ever noisy market place and understand market behaviour

In most cases, information technology is assumed that upward market movement ways more than buyers than sellers and vice versa.

In that location are times when this logic is wrong, and this is when nosotros turn to indicators. They are every trader's tool to spot loopholes and employ trading signals to your advantage.

The goal of this article was to succinctly encompass all there is to know about forex indicators. No matter how challenging forex can be, with indicators, you can reduce the risks of losses.

It is hard to make up one's mind what the best trading indicator is, withal, you can find the ones that work all-time for you lot.

Hope this article has been helpful?

Allow us know which is your favourite forex indicators and why in the comments beneath.

Cheers for reading.

FAQs

Source: https://www.forexgdp.com/forex-indicators/

Posted by: stewartsafelip1955.blogspot.com

0 Response to "What Is Profit In Forex"

Post a Comment